Denika Heaton, BBA, JD, TEP, CEA Tax and Estate Planning Specialist, Private Wealth

Chris Hanley, CPA, CA, CFP Tax and Estate Planning Specialist, Private Wealth

Key Takeaways

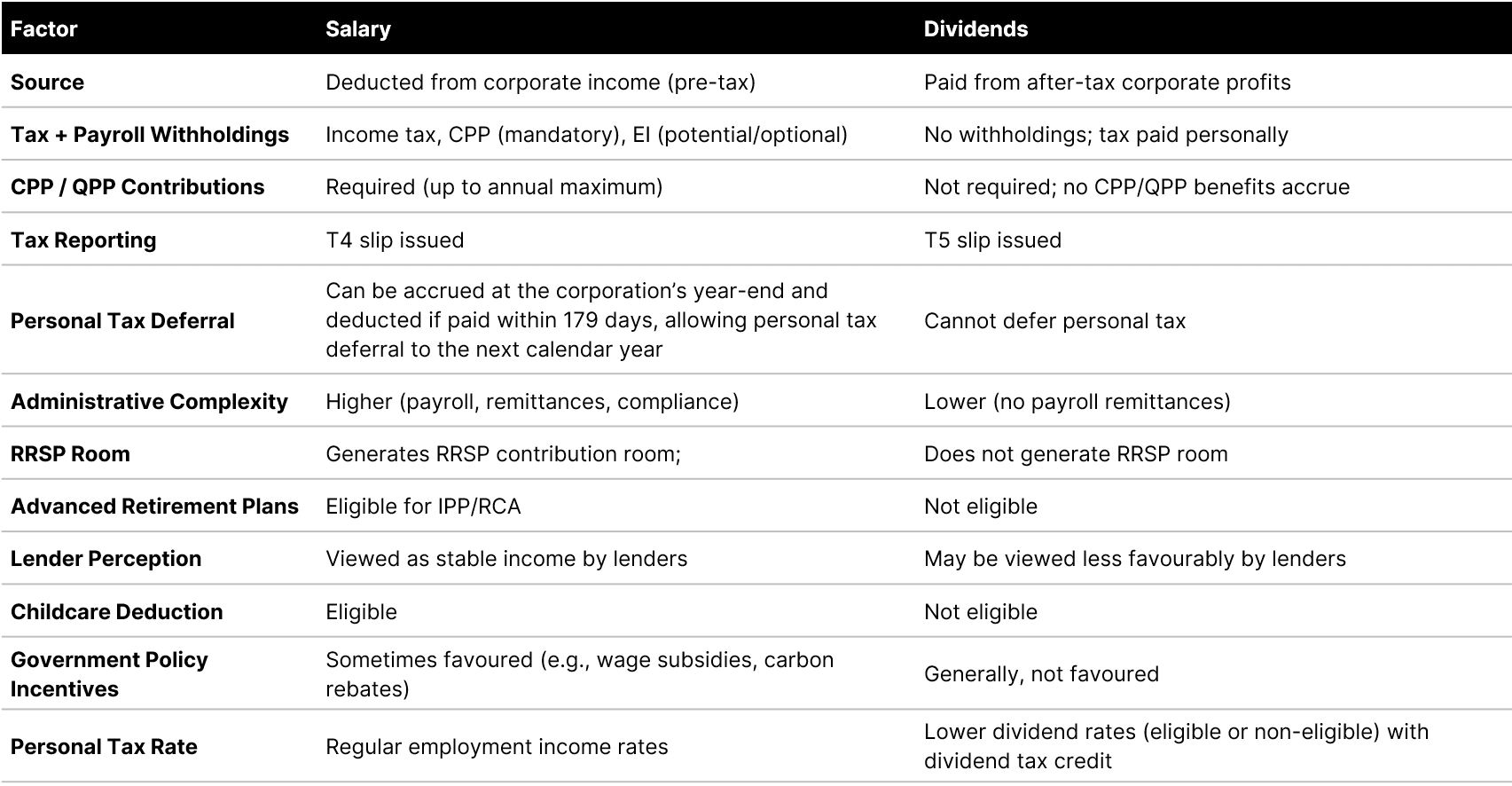

- Owner-managers can choose between salary, dividends, or a combination. Each option has distinct tax implications that vary by province and income level

- Salary builds RRSP contribution room and CPP benefits, while dividends offer administrative simplicity but limit retirement savings opportunities

- The choice affects more than taxes: it impacts mortgage qualification, childcare deductions, and eligibility for government programs

- Administrative considerations and compliance requirements vary from simple to complex

- Your optimal compensation strategy depends on your family situation, retirement goals, cash flow needs, and future borrowing plans

After incorporating your business and getting operations underway, you’ll face an important decision about how to pay yourself as an owner-manager. As discussed in Starting Strong: Benefits of Incorporating Your Business, one of the advantages of a corporation is the flexibility it provides in structuring your compensation: you can draw a salary, receive dividends, or use a combination of both.

In this article, we'll examine each approach, outlining the tax implications, planning opportunities, and practical considerations. Our goal is to help you understand the pros and cons of each option so you can have informed conversations with your accountant and make confident decisions for your financial future.

Salary

When you pay yourself a salary from your corporation (also referred to as wages or payroll and includes bonuses), you’re considered an employee of your own company. The corporation is responsible for withholding and regularly remitting income tax, Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) contributions, and, in some cases, Employment Insurance (EI) premiums on your behalf.

While EI is generally optional for owner-managers and beyond the scope of this article, CPP contributions are mandatory on salary income up to the annual maximum. These required contributions have increased as part of CPP enhancements, ultimately providing greater retirement benefits. Your corporation must remit both the employee portion of CPP deducted from your salary and the employer portion of CPP, resulting in a combined maximum contribution of $8,860.20 for 2025 on salary up to $81,200.1 No CPP contributions are required on salaries above this threshold.

At year-end, the corporation issues a T4 slip reporting your employment income and the amounts withheld. You are not required to make personal income tax instalments on this income, as taxes are withheld at source throughout the year. When filing your personal tax return, the taxes already withheld should generally be sufficient to cover your actual tax owing, subject to minor adjustments.

Benefits of a Salary

Drawing a salary provides several practical advantages:

Retirement savings capacity: Salary is considered “earned income,” which generates Registered Retirement Savings Plan (RRSP) contribution room, allowing you to save more for retirement on a tax-deferred basis by contributing to your own or a spousal RRSP. For those seeking more advanced retirement planning options, a salary can make you eligible for Individual Pension Plans (IPPs) or Retirement Compensation Arrangements (RCAs), which offer additional opportunities for tax-efficient retirement savings.

Credit qualification: When applying for personal credit, such as a mortgage or loan, many lenders prefer to see employment income reported on a T4, as it is viewed as more stable than dividend income.

Tax deductions: Only salary income qualifies for the childcare expense deduction, which can be a valuable tax benefit for families with young children.

Government programs: Government policy has at times favoured salary over dividends. For example, during Covid-19, programs like the Canadian Emergency Wage Subsidy and CEBA loans were available to companies that paid salaries. More recently, the Canada Carbon Rebate for Small Businesses (in certain provinces) has been based on the number of employees. While these factors may be relevant in your salary versus dividends analysis, they are generally secondary considerations.

Tax Treatment of Salary

From a tax perspective, salary is deductible to the corporation as an expense, reducing the company’s taxable income. You, as the owner-manager and employee, will pay personal income tax on the salary received, with taxes withheld at source and remitted throughout the year.

A corporation can accrue a salary or bonus expense at its fiscal year-end and claim a tax deduction, provided the amount is paid within 179 days. This allows business owners to defer personal taxation on the amount to the following calendar year, depending on the corporation’s fiscal year-end, while still receiving a deduction for the company. Such a deferral is not available with dividends.

The Canada Revenue Agency (CRA) generally does not challenge the amount of salary paid to active owner-managers. However, if you pay a salary or bonus to spouses or other family members, the amount must be reasonable for the value of services they provide. If the payments are considered unreasonable, the individual may still be taxed on the income, while the corporation is denied the deduction.

Dividends

Dividends represent a share of the corporation’s after-tax profits paid out to shareholders. When you pay yourself dividends, you are compensated as a shareholder rather than as an employee. The corporation does not withhold income tax at source; instead, you report the dividend income on your personal tax return and are responsible for paying all related taxes yourself. If your tax owing in the previous year exceeded $3,000, you’ll generally be required to make personal tax instalments throughout the year.

Dividends are reported on a T5 slip, and no CPP contributions or EI premiums are required on these payments. As a result, you will not accrue benefits under those programs from dividend income.

Benefits of Dividends

While dividends don’t provide the same retirement planning advantages as salary, they offer their own benefits:

Administrative simplicity: No payroll remittances or source deductions to manage, reducing administrative burden.

Immediate cash savings: No CPP contributions mean more immediate cash flow, though this comes at the cost of reduced future CPP retirement benefits.

Dividend Limitations

There are a few limitations:

No retirement savings room: Unlike salary, dividends do not generate RRSP contribution room, nor do they make you eligible for advanced pension arrangements like IPPs or RCAs.

Credit considerations: Dividends are generally less helpful when applying for credit, as lenders may view this income as less stable or predictable than employment income.

No childcare deduction: Dividend income does not qualify you for the childcare expense deduction.

Tax Treatment of Dividends

From a tax perspective, dividends are not deductible to the corporation, meaning the company pays tax on its profits before distributing dividends to shareholders. However, dividends are taxed at lower personal rates than salary because you receive a dividend tax credit on your personal tax return, which recognizes the corporate tax already paid.

The actual tax advantage depends on your overall income level and the type of dividend received:

- Non-eligible dividends, typically paid from income taxed at the preferential small business rate, receive a smaller tax credit and are taxed at higher personal rates than eligible dividends.

- Eligible dividends, which are paid from income taxed at the higher general corporate rate (i.e. income in excess of the small business deduction), receive a higher dividend tax credit and are taxed at lower personal rates.

Special tax rules limit the amount of dividends that can be paid to family members who are not actively involved in the business, known as Tax on Split Income (TOSI). These rules are complex and should be discussed with your tax advisor.

Comparing Your Options:

Which approach makes sense for you?

Choosing between salary and dividends requires careful consideration of your specific situation and goals. Although Canada’s tax system aims for “integration”, meaning the combined corporate and personal tax paid should be similar whether you take salary or dividends, in practice, the system doesn’t always work perfectly. Additionally, personal priorities such as retirement planning or administrative simplicity may outweigh small differences in tax cost.

As your business and personal circumstances change, the optimal approach can change as well. It’s important to revisit your strategy regularly with a tax advisor to ensure it continues to serve your needs.

Three Scenarios

To illustrate how different circumstances can lead to different compensation strategies, consider these examples.

Scenario 1: Alex

Scenario 2: Ahmed

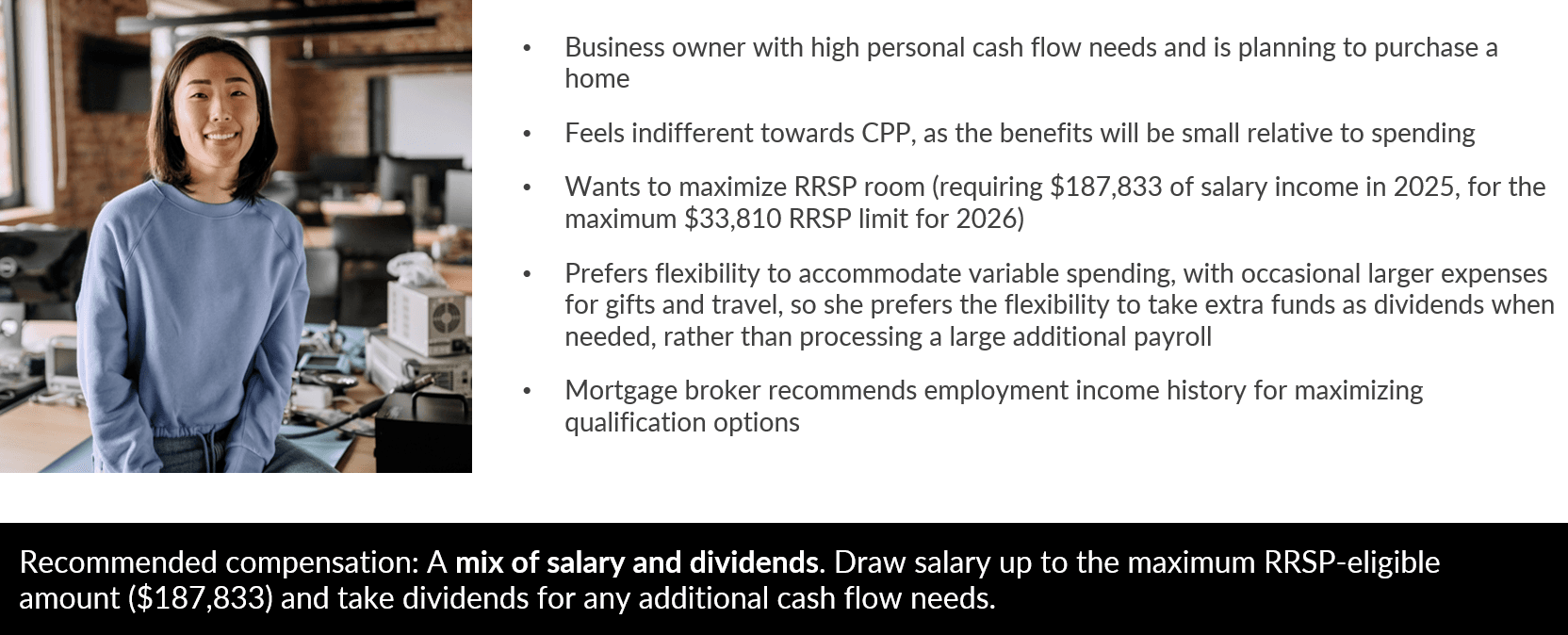

Scenario 3: Mei

The right choice depends on your income needs, family situation, retirement planning, and even your future borrowing plans. Your province of residence and overall tax situation will also affect whether there is a tax benefit or cost to your compensation choice.

Looking Ahead

If you are already accumulating investments inside your corporation, tax efficient withdrawal planning becomes even more important. The next article in the series will address earning and withdrawing investment income from your corporation in the most tax efficient manner.

How We Can Help

Our Tax and Estate Planning team is ready to assist you with navigating the complexities of owner-manager compensation planning by working closely with your tax professional to develop a strategy tailored to your family’s unique needs. Please reach out to your Mawer Investment Counsellor to discuss how we can support your compensation and planning goals.

All tax information sourced from the Canada Revenue Agency as of October 2025